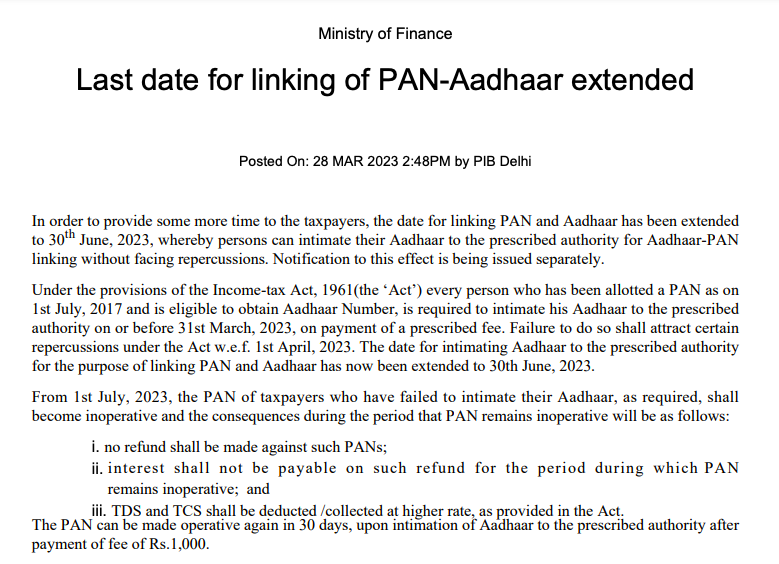

The Income Tax Department of India has announced the extension of the deadline for linking PAN with Aadhaar to June 30th, 2023. This is good news for taxpayers who were struggling to meet the previous deadline and provides more time to complete the process without facing any penalties or consequences. The process of linking PAN with Aadhaar is mandatory for all taxpayers and is essential for filing income tax returns. The process can be completed online by visiting the official website of the Income Tax Department of India and following the steps outlined on the portal.

This extension comes as a relief to many taxpayers who were facing difficulties in linking their PAN with Aadhaar due to various reasons such as technical glitches or personal circumstances. The process of linking PAN with Aadhaar is mandatory for all taxpayers and failure to do so can result in penalties and other legal consequences.

To link PAN with Aadhaar, taxpayers can visit the official website of the Income Tax Department of India and follow the steps outlined on the portal. The process is simple and can be completed online by providing the necessary information and documents.

With the new deadline extension, taxpayers now have more time to complete the linking process and avoid any penalties. It is important to note that failure to link PAN with Aadhaar can result in the deactivation of the PAN card and even a fine of up to Rs. 1,000.

The extension of the deadline for linking PAN with Aadhaar also provides an opportunity for taxpayers to ensure that their financial records are up to date and accurate. This can help them avoid any future complications or legal issues related to their tax filings.

The extension of the deadline for linking PAN with Aadhaar is a welcome relief for taxpayers who have been facing challenges in completing the process. Taxpayers are encouraged to take advantage of the extended deadline and complete the linking process as soon as possible to avoid any penalties or other legal consequences.

Leave a Comment