The Income Tax Department has finally made a clarification to those who will not link their Aadhaar with Pan Card will have to face some serious consequences while filing their Income Tax Returns. Now Income Tax Department has declared the last date for lining the Aadhaar card with Pan as August 31, 2017. Citizens who have already applied for the same can check their status of the linking by visiting the official website of Income Tax Department,https://incometaxindiaefiling.gov.in/

After you login, you need to search for the profile settings tab and click on to it and then you can check whether your aadhaar number is linked or not. The citizens who have not yer linked their Aadhaar Card with pan card, they need to follow the steps for doing so: Firstly you need to log on to the Income Tax Department’s e-filling portal, www.incometaxindiaefiling.gov.in. Then you need to enter your Aadhaar and Pan card number in the spaces provided along with the Captcha code that is provided. Then click on the ‘Link Aadhaar’ Button.

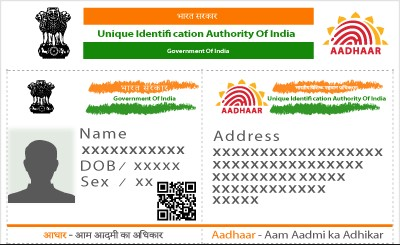

One thing that you should always make sure of is that the name mentioned in the Aadhaar card should be same as the name on the PAN card. In case you find any variance like spelling mistakes or many a times of full name then the linking might not be possible. In this case where there is a discrepancy, then you need to update your Aadhaar card and then look forward to linking with PAN card. The problems you may face if you delay or ignore the process notified: Your ITR will not be proceeded and it will be considered that you have not filled it and after that you might have to face the consequences for not filing income tax return as well.

You will also be penalized for the same by ITD under section 142(1). Also the assessing office may levy a penalty of Rs 5,000. Moreover you won’t be able to claim or carry forward your losses in business. It will also definitely affect the process of refunds as well and your refunds shall not be granted. Interest under section 234 A, B, C will be applicable as the case may be, i.e., if the tax is payable.